44 gift card accounting rules

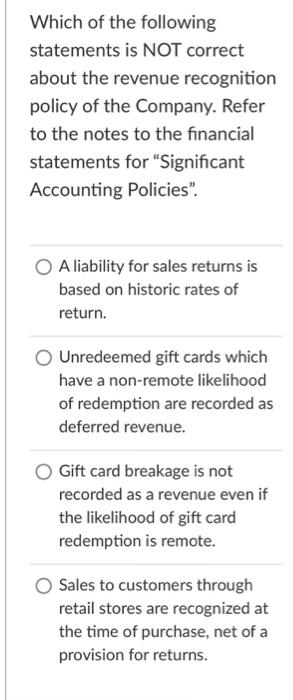

Restaurant Owners, Are You Accounting for Gift Cards Correctly? The new rules hold that breakage is determined by the historical redemption rates and recognized in proportion to the actual redemptions of the gift card. ASU 2014-09 does still allow companies to use the remote method, however, the standard states that this method should only be used when a company expects there to be no breakage at all. Gift Card Accounting, Part 1: The GAAP Standards - Firm of the Future Escheat statutes require retailers to turn over unredeemed portions of gift cards after three to five years. For some states, it's the entire unredeemed balance, but most commonly 60 percent of the balance is paid over to the state. The new guidance does not apply to those portions that are subject to escheatment laws.

New rules accelerate recognition of unredeemed gift cards Accounting & Auditing New rules accelerate recognition of unredeemed gift cards By Tammy Whitehouse Wed, Feb 21, 2018 12:15 AM Gift card issuers have a new post-holiday-season hangover issue to address this year as they adapt to new accounting rules on how to recognize gift card revenue. THIS IS MEMBERS-ONLY CONTENT Already a Member? SIGN IN here.

Gift card accounting rules

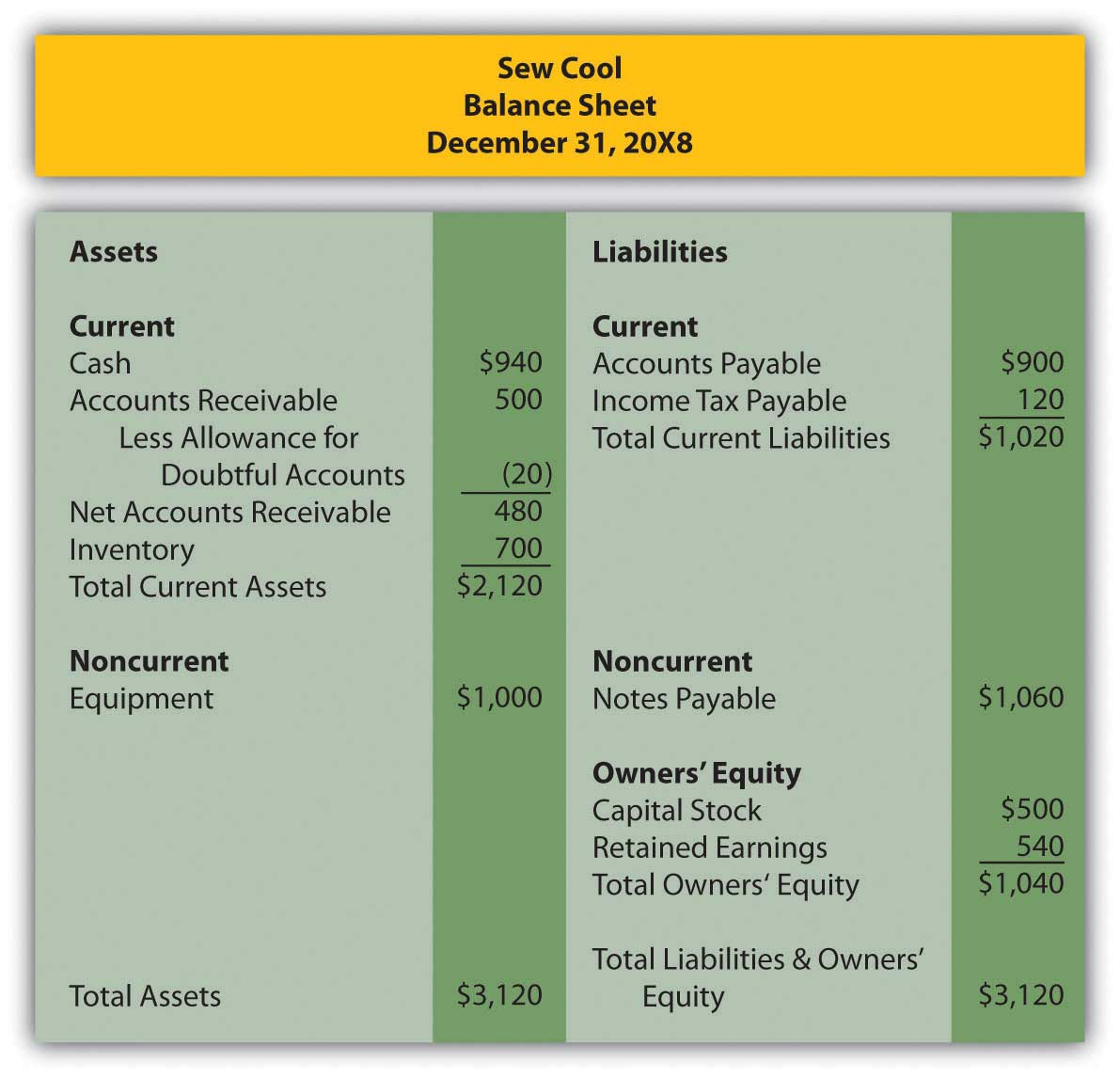

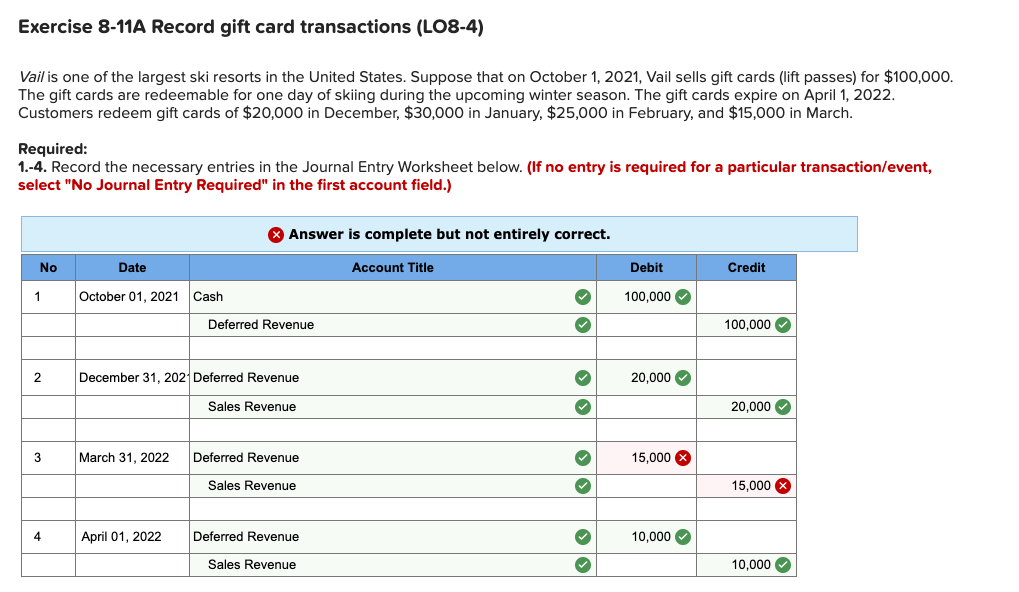

Accounting for gift cards — AccountingTools The essential accounting for gift cards is for the issuer to initially record them as a liability, and then as sales after the card holders use the related funds. There are varying treatments for the residual balances in these cards, as noted below. Liability Recognition Accounting For Gift Cards Irs Rules Login Information, Account|Loginask Gift Card Accounting, Part 2: The Rules for Tax . trend . Unlike the GAAP rules that allow deferral until the card is actually used, the IRS only allows gift card sellers to defer the income until the end of the next tax year, or in some circumstances, until the end of the second year after the cards are sold. Accounting for Gift Cards - Journal of Accountancy The accounting for the initial sales transaction for a gift card does not reflect any presumed value but rather a liability for deferred revenue, which presents challenges for analysts. The author's analysis suggests that while certain trends in the reporting of gift card transactions are emerging, practices are far from uniform.

Gift card accounting rules. Gift Cards and Gift Certificates Statutes and Legislation Ala. Code §35-12-73 (b) (1) A gift certificate, gift card, or in-store merchandise credit issued or maintained by any person engaged primarily in the business of selling tangible personal property at retail is exempt from reporting under this article. Alaska. Alaska Stat. §34.45.760. Accounting For Gift Cards Irs Rules - event.rescrf.com For companies on the cash basis of accounting, it's straightforward: giftcard revenue is recognized when the cash from the sale of the giftcard comes in. Full recognition = cash basis But forcompanies on the accrual method, the IRS gives businesses two choices. The simplest method is full recognition. See more result ›› 97 Visit site Gift Card Accounting, Part 2: The Rules for Tax - Firm of the Future The one-year deferral applies to gift cards that can be redeemed for goods or services, or a combination of both. If the cards will be redeemed chiefly for goods, a two-year deferral period is allowed. This means that all the revenue for gift cards must be recognized on the tax return by the end of the second year after they're sold. Accounting For Gift Cards Irs Rules - amys.youramys.com Gift Card Accounting, Part 2: The Rules for Tax . trend . Unlike the GAAP rules that allow deferral until the card is actually used, the IRS only allows gift card sellers to defer the income until the end of the next tax year, or in some circumstances, until the end of the second year after the cards are sold.

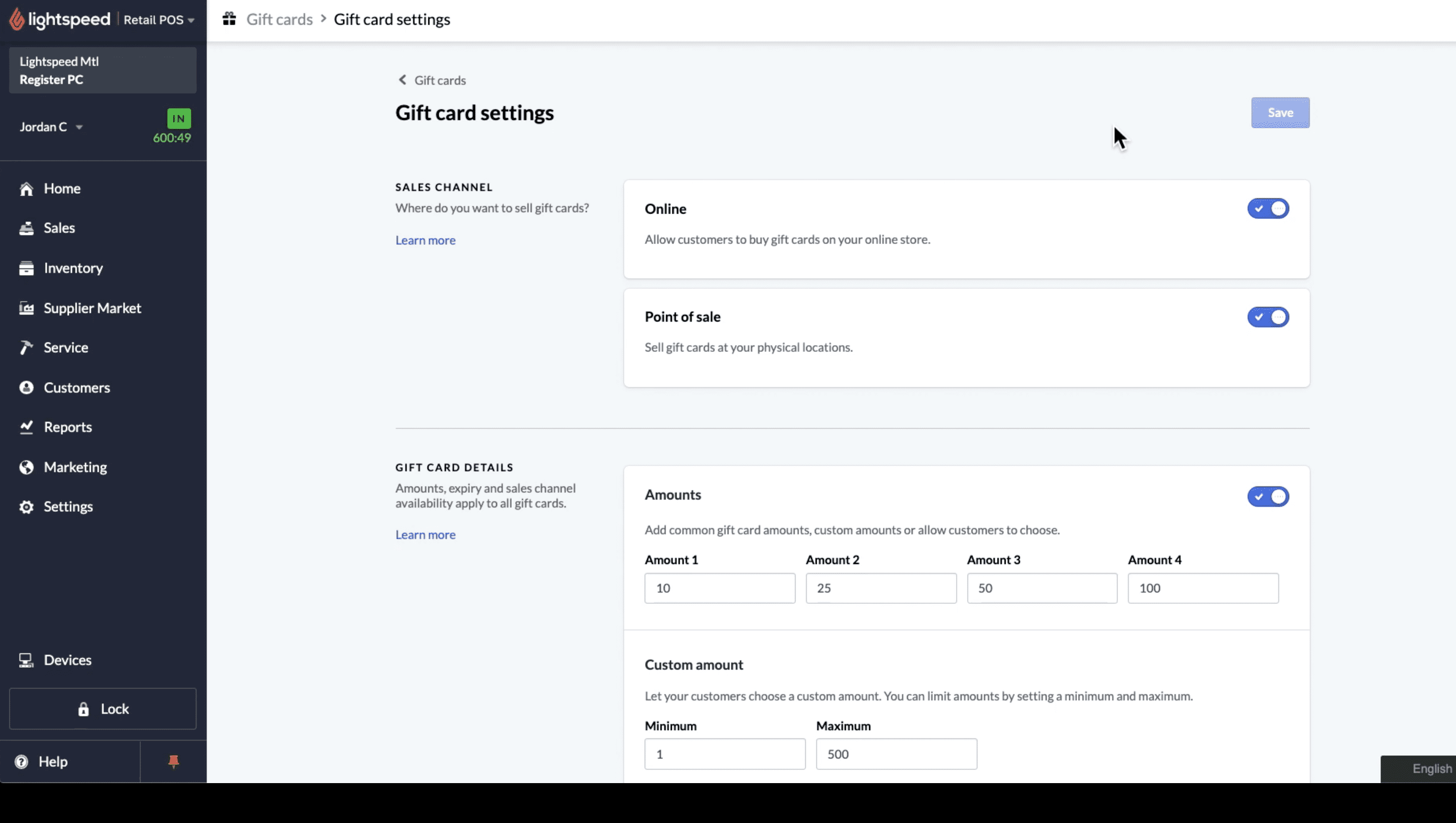

Accounting For Gift Cards Irs Rules - oym.tinosmarble.com Gift Card Accounting, Part 2: The Rules for Tax . trend . Unlike the GAAP rules that allow deferral until the card is actually used, the IRS only allows gift card sellers to defer the income until the end of the next tax year, or in some circumstances, until the end of the second year after the cards are sold. Accounting for Gift Cards: Prepare for the Holiday Season - GBQ Revenue recognition and accounting treatment Gift cards are sold for cash, are redeemable later, and are accounted for in accordance with ASC 606. The company cannot record revenue when the gift card is purchased since the company is obligated to provide service at a later date. What Do You Know About Gift Card Accounting? - QuickBooks Because you know a portion of all sold gift cards is likely to remain unused, you can account for those amounts immediately. If your client sells a $200 gift card, you might note $160 in current liabilities and then put the other 20% of the gift card's value straight into the revenue column. New Accounting Rules for Gift Cards Redeemable by Unrelated Entities IRS modifies rules allowing the deferral method of accounting for advance payments received for the sale of gift cards that are redeemable by an unrelated party. On July 24, the Internal Revenue ...

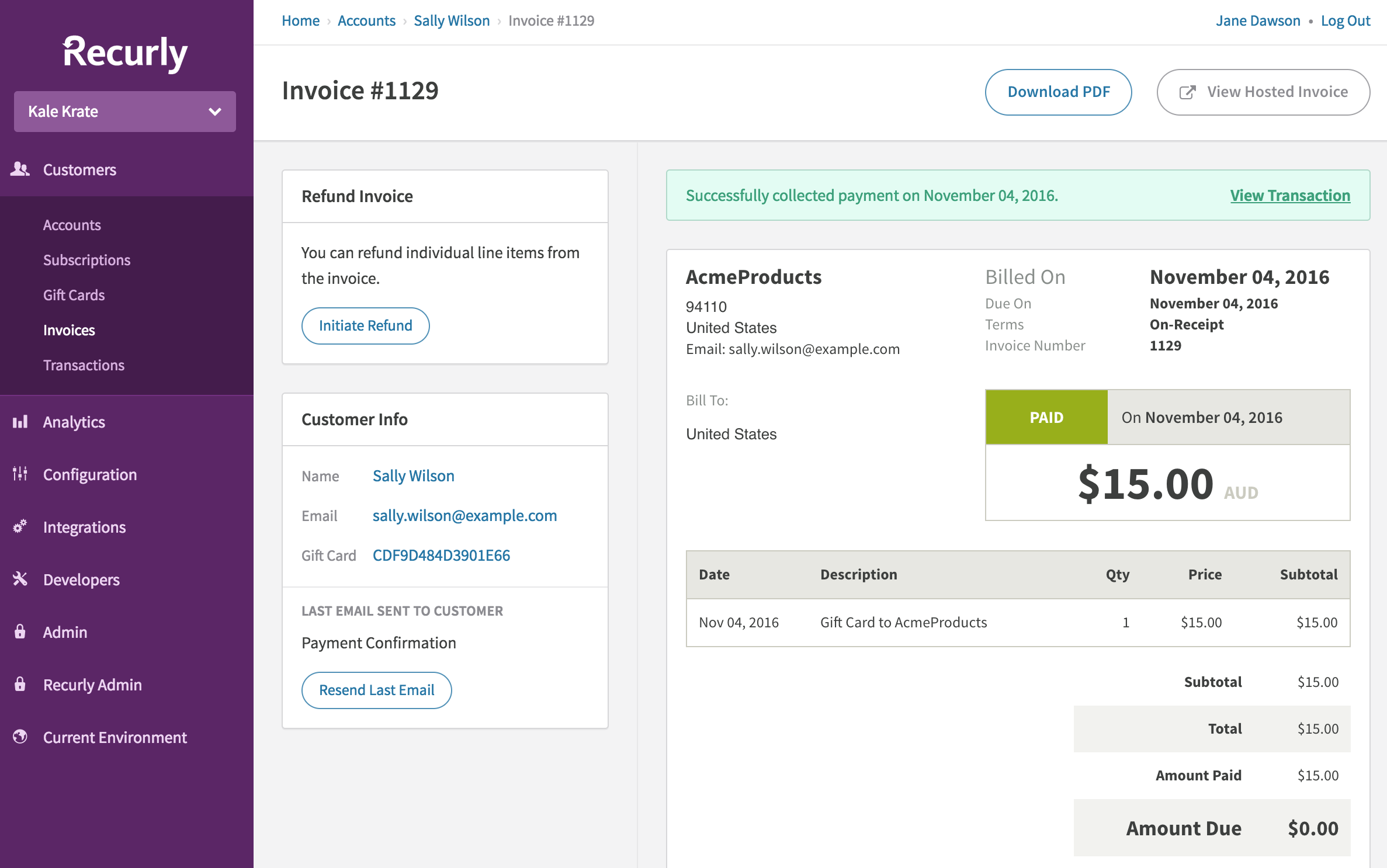

How should the sale of gift certificates be recorded in the general ... Accounting for the Redemption of a Gift Certificate When a gift certificate is presented to the retailer, revenue will be recorded by the retailer for the amount of merchandise or services that were provided. This is done with a debit to the liability account Gift Certificates Outstanding and a credit to a revenue account. New revenue recognition standard: accounting for gift cards The new standard is effective for all private companies with fiscal year beginning after December 15, 2018. When a gift card is purchased, your company should not record revenue; instead, the purchase of the gift card is recorded as a liability because you have an obligation to provide services or goods at a later point in time. New Accounting Rules for Gift Cards Redeemable by Unrelated Entities ... IRS modifies rules allowing the deferral method of accounting for advance payments received for the sale of gift cards that are redeemable by an unrelated party. On July 24, the Internal Revenue ... IRS Clarifies Gift Card Redemption Accounting Rules Revenue Procedure 2013-29 spells out what happens when a gift card is redeemable by an entity whose financial results are not included in the taxpayer's applicable financial statement, so the taxpayer should then recognize the payment in income to the extent the gift card is redeemed.

New & Improved Accounting Rules for Prepaid Cards | KPM In March, the FASB published Accounting Standards Update (ASU) No. 2016-04, Liabilities — Extinguishments of Liabilities (Subtopic 405-20): Recognition of Breakage for Certain Prepaid Stored-Value Products. It says that liabilities generated by sales of prepaid cards are financial liabilities. Although the revenue recognition guidance does ...

Accounting For Gift Cards | Double Entry Bookkeeping The amount is credited to the balance sheet gift cards liability account (deferred revenue). The gift cards account represents the value of gift cards outstanding on which the business has an obligation to supply goods at a future date. The account is included in the balance sheet as a current liability under the heading of deferred revenue.

Accounting for Gift Cards - Journal of Accountancy The accounting for the initial sales transaction for a gift card does not reflect any presumed value but rather a liability for deferred revenue, which presents challenges for analysts. The author's analysis suggests that while certain trends in the reporting of gift card transactions are emerging, practices are far from uniform.

Accounting For Gift Cards Irs Rules Login Information, Account|Loginask Gift Card Accounting, Part 2: The Rules for Tax . trend . Unlike the GAAP rules that allow deferral until the card is actually used, the IRS only allows gift card sellers to defer the income until the end of the next tax year, or in some circumstances, until the end of the second year after the cards are sold.

Accounting for gift cards — AccountingTools The essential accounting for gift cards is for the issuer to initially record them as a liability, and then as sales after the card holders use the related funds. There are varying treatments for the residual balances in these cards, as noted below. Liability Recognition

:max_bytes(150000):strip_icc()/Ross-Dress-for-Less-Worst-Gift-Card-Rules-Fees-576ce6355f9b585875053e1a.jpg)

0 Response to "44 gift card accounting rules"

Post a Comment